PE sets sights on Research, Insights and Analytics sector

Author: San Datta, Partner, EMEA

The last week has seen both Qualtrics and Momentive, both large and global publicly-listed CX businesses in the research, insights and analytics sector, receive buyout offers from Silver Lake and Symphony Technology Group, respectively, to go private. Following on the heels of Advent International’s acquisition of NielsenIQ in 2021 and subsequent merger with GfK in 2022, and Bain Capital’s acquisition of Kantar back in December 2019 this firmly places many of the largest players in the sector in the hands of financial sponsors.

At one level, these two latest deals look opportunistic. Headline revenue multiples of 7.5x for Qualtrics (EV of $12.5Bn) and 3x for Momentive (EV of $1.5Bn) compare very favorably with the 14x revenue which Thomas Bravo paid for Medallia in a $6.4Bn transaction announced 2 years ago in a much more favorable SaaS valuation market. And even though both were at a significant premium to their share price just before acquisition (73% for Qualtrics and 46% for Momentive), the offers are at a material discount to where both businesses were trading just twelve months ago (as well as a material discount to Zendesk’s failed $4.1Bn acquisition of Momentive a year ago) and even further from their share price peaks.

To be fair, although underlying revenue growth at both businesses remains strong at 12-15% on a three year forward basis, both businesses have not been immune to the broader woes afflicting the tech sector. Both businesses have restructured and reduced their workforces by 5-10% through Q4 2022 and Q1 2023; both are facing higher customer acquisition costs; and both are seeing a near-term slow-down in revenue growth across several customer or solution segments.

With that in mind, why is this sector potentially at the vanguard of a technology and software M&A bounce-back?

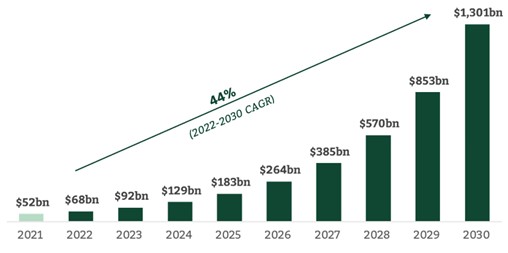

The answer is the market opportunity. However you define the market and its sub-segments, be it customer experience, experience management, consumer insights or simply ResTech, it is a huge and growing market. Customer and experience management alone is an addressable market of over $60Bn. The broader research, insights and analytics market is estimated at over $125Bn, and some of these markets are growing annually at double-digit percentage growth rates. Why? Simply put, there is a real and growing need for corporates and brands to have a rich, comprehensive and real-time understanding of what their consumers are thinking, how they’re behaving and how best to engage with them. Whether that is to drive sales, launch new products or enhance customer loyalty which are just some of the solutions offered by players in this space.

Even more interestingly, this market is being increasingly viewed as a key “tip-of-the-spear” entry point to unlock share of wallet for the broader digital marketing and transformation sectors. Ultimately, understanding consumer behavior and needs is critical to developing best-in-class front-end digital marketing services, whether that’s designing brand strategy, creative concepts, user experience or the customer journey. This broader market is over $500Bn and as private equity owners think about the eventual exit opportunities, there is a whole world of players such as Accenture, Cognizant or IBM for whom this capability is becoming an increasingly important part of their broader service offerings.

From an investment perspective, if you’re looking for exposure to this sector, there are a number of private platforms available like Qualtrics and Momentive, the parent company of Survey Monkey, with large enterprise clients such as Uber, P&G, Coca-Cola and Pfizer. The playing field is highly fragmented with many smaller tech vendors seeking to scale at an enterprise level with strong product offerings which are ripe for consolidation. There are also many mid-tier ResTech platforms like Suzy, Quantilope, Prodege and Zappi which are backed by private equity sponsors who will ultimately sell or combine in the coming years. This provides a large and real investment opportunity across this space which can accelerate the organic growth, embed client relationships, unlock new revenue streams, open new client opportunities, and deepen their competitive moat.

Will it all be smooth sailing for these companies? Almost certainly not. Many of the larger tech vendors are well placed to build out product offerings in this sector, leveraging existing customer relationships and data capabilities. Similarly, businesses with deep tech and advanced AI/ ML capabilities may disrupt on their front-end data aggregation and analytic capability. And there’s a real possibility that clients start to demand more and more of an advisory layer on top of these solutions, which may limit their ability to scale as quickly and could eat into their higher software margins.

However, from where we sit today, with the capital that the firms like Silver Lake bring to the party, they’ve got everything to play for, and we see the market as one of real opportunity in the year ahead.

If you would like to receive copies of our Insights and Reports please click here