Q2 Public Market Update

Key Takeaways

Total equity market value up by 7% since April 2021

The Media, Marketing, Information & Technology public equity markets continue to prosper, with the total equity market value up by 7% since April 2021.

2021 revenue growth of 17% across all sectors

Led by +28% growth across the eCommerce and digital media sectors, 2021 forecasted revenue growth remains strong across all sectors at 17% vs 2020. Notably, the Marketing Technology sector is also forecasting strong year on year revenue growth of +20%.

2021 EBITDA growth of 17% across all sectors

Favorable outlook for 2021 EBITDA, with nearly all sectors expecting double digit growth vs. 2020. Very positive outlook for Digital Media vs. 2020 with several sub-sectors including search and social media expecting +30% year on year EBITDA growth.

Valuation environment remains robust with the Media, Marketing, Information & Technology markets having increased by 7% ($975bn) since Q1 2021. This is underpinned by strong forecasted 2021 revenue growth across all sectors, with an average of 17% across the market, representing total incremental revenue across the market of nearly $455bn.

The total market value of the Media, Marketing, Information and Technology Sectors has increased by 7% since April 2021

AdTech and MarTech emerge as leaders of TMV growth in Q2 2022

- The main drag on TMV growth through Q2 2021 has been eCommerce. While the growth outlook for these sectors remain positive, the sector was able to withstand the decline in Price Comparison and Consumer Verticals and saw TMV growth of 4% in Q2

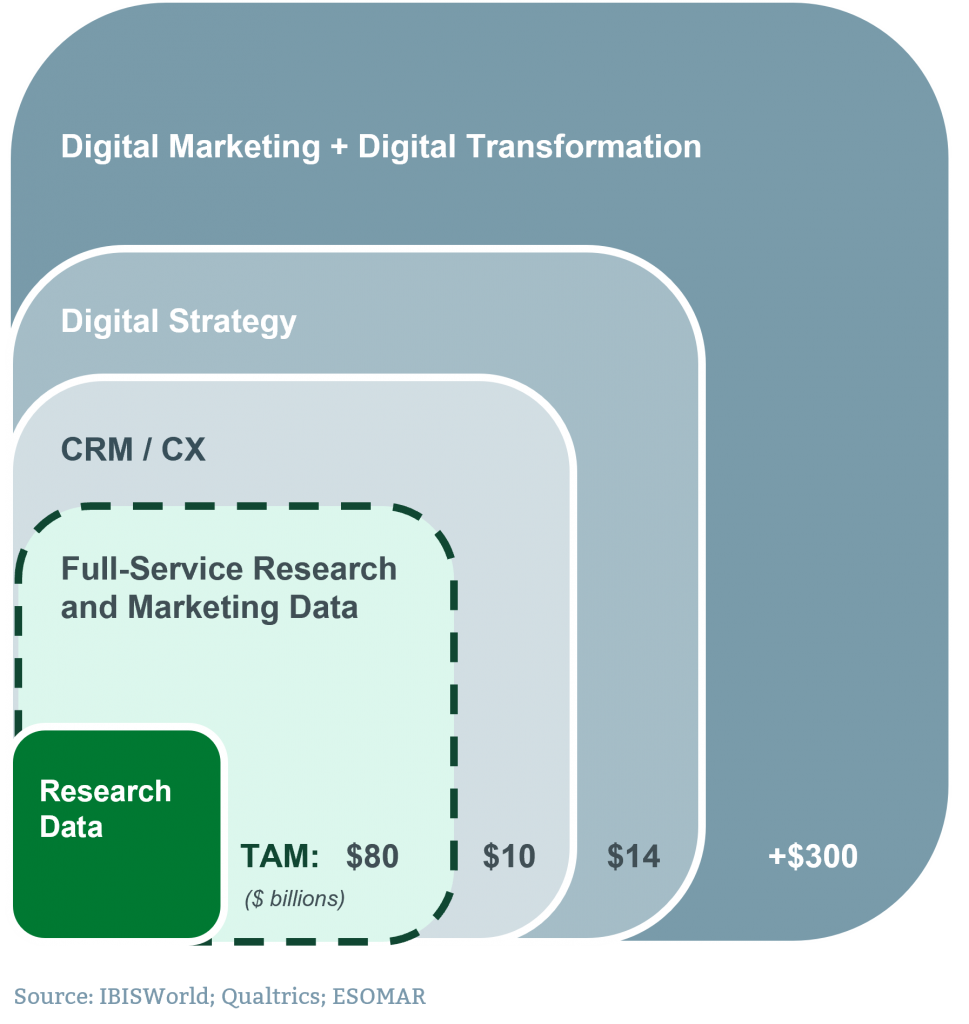

- Investor demand for businesses exposed digital transformation solutions and best-in-class CX is similarly reflected in TMV growth in both Tech & Consulting Services (up 7%) and Insights, Data, Analytics (up 12%)

- The Digital Media sector, led by companies such as Facebook, Snap and Google, also continues to perform, up 7% ($4,015bn of TMV) over the period. The sector benefits from powerful tailwinds, including strong and growing demand for performance marketing

Forecast 2021 revenue growth of +10% for many sectors

- Strong 2021 revenue growth is projected by current market forecasts for nearly all sectors. The growth is driven by powerful tailwinds across many sub-sectors and a “bounce-back” in revenues in those sectors most impacted in 2020

- Total revenue growth is forecast at c.17% from 2020 to 2021, signifying an aggregate increase in revenues across all sectors of close to $455bn, with double-digit percentage growth expected across many sub-sectors

Driving double-digit EBITDA growth for 2021

- eCommerce is expected to have the strongest revenue growth, increasing by 28% to $997B, showing a limited correlation with the change in TMV

- With Publishers & Lead Generation being the key sub-sector of growth and benefitting from demand from the eCommerce vertical, the Digital Media sector is forecast as a high performer with growth of 28%

Current market forecasts show that FY21 revenue growth across the Media, Marketing, Information and Technology sectors is expected to be 17% with 17% average EBITDA growth across the sectors in the same period