Content and Commerce. A Perfect Storm.

Key Highlights

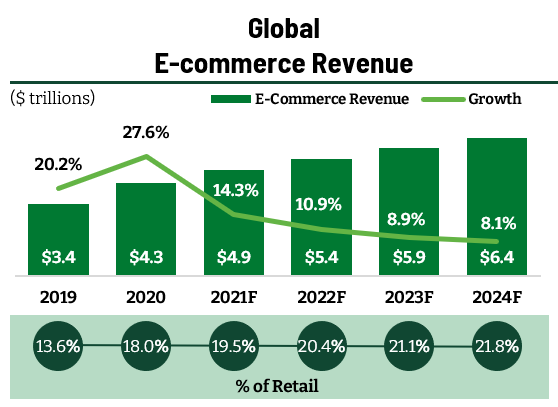

Global E-commerce Market Continues to Grow and Attract Record Investment

27% global e-commerce market growth in 2020 up to $4.3tn total global revenue

$35bn invested globally in 2020 across the e-commerce sector

133% increase in total investment on prior year

e-commerce Content is Becoming Increasingly Vital

The global Product Information Management (PIM) market will be $16bn in 2025, growing at a CAGR of 12.2%

80% of purchasers have abandoned transactions due to poor product content

58% of shoppers place the blame on not having enough information

12-36% increase in shopper conversions with rich product detail pages than those without

E-commerce Growth Outpacing Overall Retail

E-commerce growth continues to far outpace overall retail growth with penetration rates approaching 20% this year aided by improvements in the quality of online shopping experiences. These improvements have come about due to record levels of investing across the e-commerce category, massive spending by brand and merchants on e-commerce infrastructure, storefronts and content, and continued innovations in digital and DTC marketing.

Covid-19 has only served to accelerate e-commerce adoption permanently, further fueling investments in technology, content, features and functionality.

99% of Business Leaders believe that quality product content is important to sales growth through digital channels

source: eMarketer

Massive Brand Spend Shifting to e-commerce Execution

While the e-commerce experience might seem simple and fluid from the consumer perspective, successful e-commerce execution is extremely complex. Media spending, customer acquisition, offer and inventory management, visual merchandising, payments, CRM, product information, reviews and referrals, fulfillment, reverse logistics, and, of course, site performance … each of these individual areas of e-commerce execution are major pain points for brands and merchants alike. Each of these elements must connect to others, and many are through third-party vendors. They all must work in concert, in multiple languages and currencies, with the most up to date and real-time SKUs, pricing, specs and availability across many different e-commerce marketplaces and retailer websites.

“Content is King”… Especially In E-commerce

Across the e-commerce journey, there is one critical constant: the need for accurate, rich and informative product content. Product content is comprised of many parts from brand compliant product images and logos to rich media such as video to the detailed product information (SKU, specs, descriptions, and other technical identifiers). The volume and makeup of this content is continuously increasing and must be consistent wherever it appears as a marketing asset – Brand sites, Search results, Landing pages, Comparison shopping sites, Channel partner catalogues, Review sites, Social sharing and Customer care among others. All rendered dynamically, often personalized, and always on-demand.

The largest retailers and online marketplaces require up to date and accurate product info and rich content for their real-time execution. The cost burden is shifting to brands and is requiring significant upfront investment to succeed online.

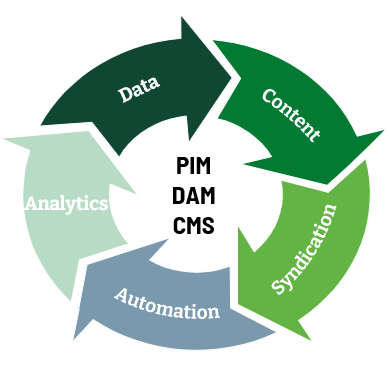

New Technology Providers Replacing Legacy Solutions

Against this backdrop, an entire ecosystem of Product Content specialists have emerged, spanning high-volume, global creative production studios to purpose built Product Information Management (PIM), Digital Asset Management (DAM) and Content Management Solutions (CMS) providers who aggregate and syndicate millions of product content assets required to keep e-commerce running.

An Active Market With Significant Investment And Consolidation

This sector has been incredibly active from an investing and M&A perspective as brands and merchants further invest in their e-commerce capabilities to meet the ever-increasing demand for flawless e-commerce experiences.

Select Financial Investor Activity

In Summary

As brand spend shifts to e-commerce execution, the wave of investment and consolidation in content technologies and solutions that drive discovery, conversion and retention will continue. Success will be characterized by players with the right capabilities to manage and automate delivery across an increasingly fragmented landscape.

CASE STUDY – CNET Sale to 1WorldSync

- JEGI CLARITY advised Red Ventures on the sale of CNET Content Solutions (CCS) to 1WorldSync, a portfolio company of Battery Ventures

- CCS is a leader in the exchange of product information, rich content and eCommerce solutions that powers ecommerce sites from SMB to Enterprise

- Eight weeks from engagement to announcement, commencing several weeks prior to the closing of the acquisition of CNET by Red Ventures

- Combines two powerful platforms to provide brands and retailers with end-to-end product content solutions, from supply chain data to rich content that powers e-commerce