As The Metaverse adoption continues apace, there will be an unprecedented wall of expertise required to service demand

Author: Jonathan Davis, Partner, EMEA

For all the recent publicity, “The Metaverse” remains a relatively opaque concept. Perhaps the simplest way to think about it is as the potential cyberspace functionality provided by Web 3.0 (the name that signifies the third generation of the Internet).

Based upon principles of decentralization, open protocols, greater user interaction and enhanced levels of certified digital ownership, Web 3.0 leans heavily into technologies such as Blockchain (digitally distributed, decentralized data ledgers), smart contracts and digital financial instruments (such as crypto-currencies and NFTs).

These foundational technologies offer end-users greater rights and participation in financial transactions, more interactive retail, gaming and entertainment experiences, and social media platforms that blend virtual and physical environments in a more intuitive and seamless way. The ecosystem that is the nexus of these experiences is increasingly referred to as “The Metaverse”.

Though still nascent, far from cohesive and with some of its impacts possibly over-stated, The Metaverse and Web 3.0 could still be a significant inflection point in internet utility, enabling disruptive new online business models.

Inflection point in internet utility or “just” a massive M&A market?

The question of whether The Metaverse will represent an inflection point in internet utility is up for debate. Many major retailers and brands are trying to size up the opportunities Web 3.0 affords and how to respond to them strategically; creating new modes of customer engagement, partnering with gaming and entertainment companies to create offerings in potential new virtual market-places, which require new marketing and advertising tech capabilities.

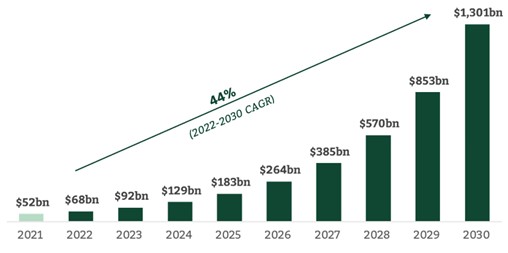

Inflection point or not, the market is already material and attracting significant investment. According to a recent study by Precedence Research, the size of this market could be in the region of $1.3tn by 2030.¹

If the prospect of The Metaverse is bringing the worlds of entertainment, gaming and retail into a new paradigm, then 3D/CGI content creation will be a serious enabler. Companies whose tech platforms and pipelines incorporate these capabilities will increasingly be of interest to brands, entertainment and games companies while also rapidly becoming a significant driver of competition and differentiation amongst agencies, VFX and CGI studios.

Although the necessary standardization required to make 3D interoperable across the web isn’t available yet, providers of game engine software, real-time rendering, IT hardware and cloud computing are all vying to establish a plan for Metaverse 3D graphics ubiquity. One example of this is the Khronos Group (a consortium of leading companies in the world of 3D graphics) with members such as AMD, Epic Games, Autodesk, Meta and Microsoft among many others and who’s motto is “Render Everything Everywhere”.

Significant investment followed by a prolonged period of M&A

Assuming that Metaverse adoption continues apace, there will be an unprecedented wall of expertise required to service demand. Brands, entertainment companies as well as advertisers all need to have the ability to create and deploy content in Web 3.0.

Skills in virtual world creation will have increasing value in the supply chain, making tech-focused creative companies a prime target for acquisition and portfolio growth. To that end, services companies such as Accenture, WPP and DEPT are all placing significant bets on its success.

Accenture has already launched Metaverse Continuum Group, an 800 person (and growing) strong division helping clients in areas such as extended reality, blockchain, digital twins and edge computing.

The next generation of the internet is unfolding and will drive a new wave of digital transformation far greater than what we’ve seen to date, transforming the way we all live and work.

Paul Daughtery, Group CEO of Technology and CTO of Accenture

WPP’s specialist creative content production company, The Metaverse Foundry, through Hogarth, develops brand experiences in The Metaverse delivered by a global team of over 700. In parallel they announced a technology partnership with Epic Games, training employees in technologies such as Unreal Engine for 3D creation and virtual production.

Our clients are already seizing the opportunities to connect with their customers presented by The Metaverse, and seeking partners who can bring experiences to life in the most creative and compelling ways.

Mark Read, CEO of WPP

Global Digital Services group DEPT, who JEGI CLARITY raised capital for from Carlyle Group in 2020, launched their 300-person Web3/DEPT offering dedicated to The Metaverse, blockchain technology and NFT services, with a stated intention to derive 20% of group revenues and growing divisional headcount to 1,200 people by 2025.

With all this investment there is no doubt that acquisitions will follow, and we are already witnessing the start of a wave of M&A, with TechMonitor estimating well over $100bn of related M&A in the last two years alone:

- Match Group paid $1.7bn for Hyperconnect, a South Korean social discovery and video tech company with whom it is developing “Single Town” a virtual space where singles can meet.

- Unity Technology acquired Weta Digital’s technology division (engineering division, artist pipeline and tools) for $1.6bn, to enable “a new generation of creators to build, transform, and distribute stunning RT3D content.”

- Epic Games raised $2 billion for Metaverse Endeavor from Sony Group Corporation and Kirkbi (family behind LEGO) in a deal that values the Fortnite creator at $31.5bn,to help fund the kid-focused metaverse content in partnership with LEGO.

- Tencent raised its stake in games developer Ubisoft, valuing the business at $10bn, with funds used to leverage existing IP in the metaverse; and probably the largest metaverse-related investment to date.

- Microsoft’s government contested acquisition of Activision Blizzard for $69bn as their own “building block for The Metaverse.”

- Growth Catalyst Partners is building out a design agency focused on the Metaverse through bolt-on acquisitions for their platform Journey. In 2022, they acquired leading agencies in digital and physical experiences (Squint/Opera and ICRAVE), voice (Skilled Creative) and metaverse/gaming/Web3 (Future Intelligence Group and TheDevHouse Agency).

Gaming is the most dynamic and exciting category in entertainment across all platforms today and will play a key role in the development of metaverse platforms.

Satya Nadella, Chairman and CEO of Microsoft

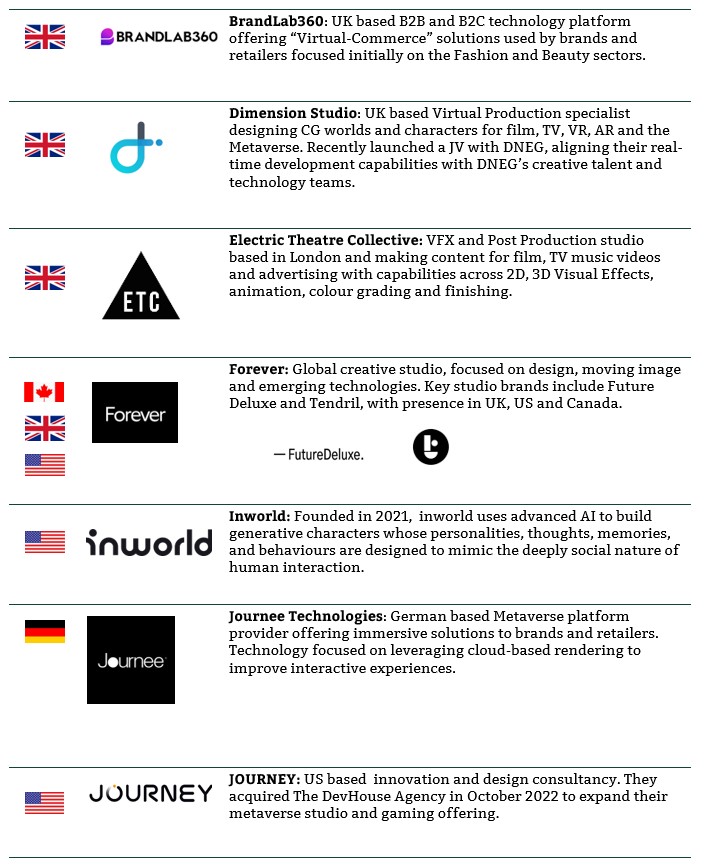

Ones to watch

Conclusion

Although no unifying definition of The Metaverse yet exists, signals clearly show that building or acquiring capabilities in this space is of increasing strategic importance as market opportunities evolve. As a result, we expect to see a material increase of investment from both industry participants e.g. marketing groups, content producers and consultancies, as well as from financial investors looking to ride positive sector tailwinds and build the next generation of Web 3.0 related products and services.

Equally, there will be increasing demand and expectations made of the technology platforms that this content will sit on. Current early movers such as Decentraland, The Sandbox, Epic and Meta are likely to be challenged as demands for real time rendering across devices become the expected standard.

Once again, expect more investment and M&A as the larger players try to keep up with technological advances.

If you would like to receive copies of our Insights and Reports please click here