The 20th Anniversary Event

Two Decades of Exceptional Evolution

Our 20th Annual Media & Technology Conference was a preeminent, must-attend event for senior executives across the media, marketing, information and technology sectors. Attendees heard intimate discussions from an array of world class business leaders and executives who shared their experiences managing through today’s fast-paced and rapidly evolving landscape as well as their strategies for success in the year ahead. Nearly 600 attendees joined us with a mixture of world-class founders and entrepreneurs, C-level executives and senior investment leaders creating an energized, vibrant and positive atmosphere once more.

Some of our key takeaways from the day include the following:

Entrepreneurial Spirit

Entrepreneurial Spirit panel hosted by Scott Peters, Co-Founder & Managing Partner of Growth Catalyst Partners, Bob Dethlefs, Founder & Former CEO of Evanta and Chairman of CyberRisk Alliance, and Doug Manoni, Founder & CEO of CyberRisk Alliance.

As we head into the Spring of 2024 the entrepreneurial spirit of the Founders we have worked with over the years has never been more apparent as companies have emerged from the pandemic with reimagined business models and an eye towards a future that brings both promise and uncertainty.

Human capital and board level cohesion has never been more important to a company’s long-term success.

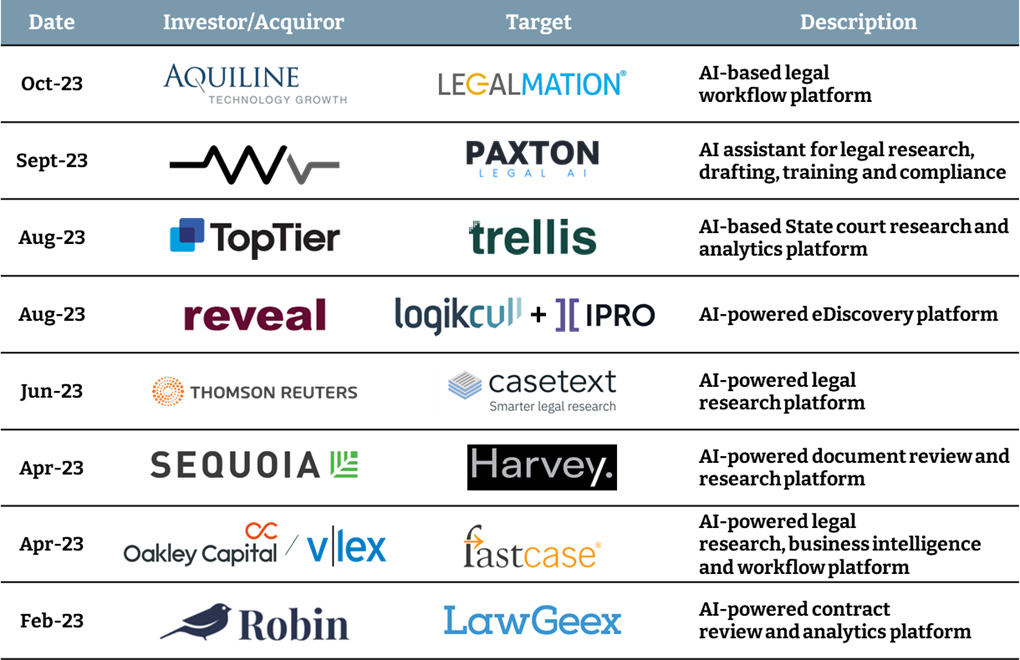

AI and Digital Transformation

Value Creation with AI – Productivity vs. Growth panel hosted by Philipp Mueller, Chief Analyst and Product Officer of Outsell, Sejal Amin, Chief Technology Officer of Shutterstock, Nikesh Kalra, Chief Operating Officer of DeepMedia, and Ilya Meyzin, Head of Data Science at Dun & Bradstreet.

AI is seen as a disruptive and transformative force of nature across the tech enabled services landscape. Early adoption of this technology is not an option; rapid yet responsible deployment of a test and learn approach is widely seen as the optimal path forward. The complexity and variety of use cases for the technology creates opportunities for consultancies and digital transformation strategists who will chart the path forward.

Retail Media

Sector insights from JEGI CLARITY’s Bob Lockwood, Managing Director and Bob Berstein, Managing Director.

Data is the fuel that drives innovation. First party data in a post cookie and privacy constrained world is essential. A major shift in power is underway between media companies and retailers as purchase data creates leverage with brand marketers and product manufacturers.

Retail Media has emerged as the hottest subsector in digital and opens the door to a more direct customer and retailer relationship. Omnicom’s recent $850M acquisition of Flywheel, a retail services platform, demonstrates this shift as well as the proliferation of Retail Media Networks that have taken market share in the past year. Walmart’s recent bid for Vizio, a CTV manufacturer with a media business is also a sign of retail’s aggressive move into media.

B2B Services

Sector insights from JEGI CLARITY’s Kathleen Thomas, Managing Director and Rich Kanefsky, Managing Director.

The transformation of B2B is well underway resulting in the integration of customer touchpoints across the discover, learn, and buy continuum. Technology drives mass personalization, content engages and educates, and experiences provide amplification when integrated into the journey.

Media Landscape

Structural Changes in Advertising: Change is Good…But for Whom? panel hosted by John Rose, Managing Director & Senior Partner at BCG, and Bill Wise, Co-Founder & CEO of Mediaocean.

Google, Facebook, and Amazon dominate the digital media ecosystem, commanding 65% of digital spend in the U.S. The open market now represents about $14B in digital spend. CTV, online video, and YouTube combined represents $63B (now larger than the $60B linear broadcast market) and growing at a 20% CAGR. Building a business outside these walled gardens can be very difficult, but building capabilities inside them can be very rewarding.

Data Readiness

Unleashing Value: The Role of Data in Driving Premium M&A Transactions and Exits insights provided by Heather Holst-Knudsen, Founder & CEO of H2K Labs and Kerry Gumas, Founder & CEO of Metacomet Advisors.

M&A transactions can be complex and unpredictable but one important factor to be thinking about is “data readiness”; the idea here is to understand that a significant portion of your company’s value is determined by the strength of your business metrics, which includes: KPI’s, benchmarks, and of course financials.

Understanding how buyers value your business beyond the bottom-line and well in advance will always pay dividends down the road when it comes time to transact.

Talent

Fireside Chat focused on Culture, Talent and Driving Innovation, by Anthea Stratigos, Co-Founder & CEO of Outsell, and Gemma Postlethwaite, Chief Executive Officer of GLG.

In the face of global crises, organizations have honed their crisis management skills adeptly but have neglected long-term strategic planning. Employees want inspiration, clarity regarding the company’s direction, transparency in its journey, and recognition of their contributions. These factors are managed differently when dealing with crises such as Covid. It is crucial to think about how to get back to a long-term strategic planning mindset.

In the era of Gen AI, the technology itself is not a barrier; the critical consideration lies in identifying which problems that technology can address effectively. It is important to be deliberate in selecting the appropriate applications for this technology.

Legal

Insights provided by Rob Dickey, Partner at Morgan Lewis.

The Corporate Transparency Act, which went into effect on January 1st of this year, requires entities formed by filings with Secretaries of State to submit beneficial ownership information to the Department of Treasury’s Financial Crimes Enforcement Network. Exemptions apply to 23 types of entities. However, many exemptions are far from straightforward in their drafting and application. Some examples of exemptions are employee headcount threshold and revenue threshold. This Act should be on all companies’ radars going forward.

2024 M&A Market

Insights from attendees and conference participants.

Private Equity investors are hungry for deals based on prolonged holding periods for many portfolios. While JEGI CLARITY has executed over 25 deals in the last 15 months, there has been a dearth of deal flow in many sectors.

M&A activity has been markedly down over the last year, primarily attributed to difficult macro-economic conditions, geopolitical uncertainty, a slowdown in tech investments and valuations and a challenging bid ask spread between buyer and seller. Companies that have managed to maintain revenues and/or grow over the last year are in a fantastic position to stand out in a supply-constrained market.

Private Equity and Strategics have scaled up sourcing efforts in an attempt to identify targets, Founders should anticipate a ton of inbound in advance of an active Spring to Summer M&A market. The time value of money and pressure from LP’s will contribute to some harvesting of portfolio gains this year and perhaps reset valuations for the coming year. Net net, there’s a window of opportunity ahead for sellers and buyers alike.

To learn more about our 2024 conference, please visit here. If you have any other questions about our conference, please contact us.