This month we examine Q1 2019 European media and technology M&A activity; current perspectives on Europe from US buyers and investors; key takeaways from Q1 activity across our sectors and other news.

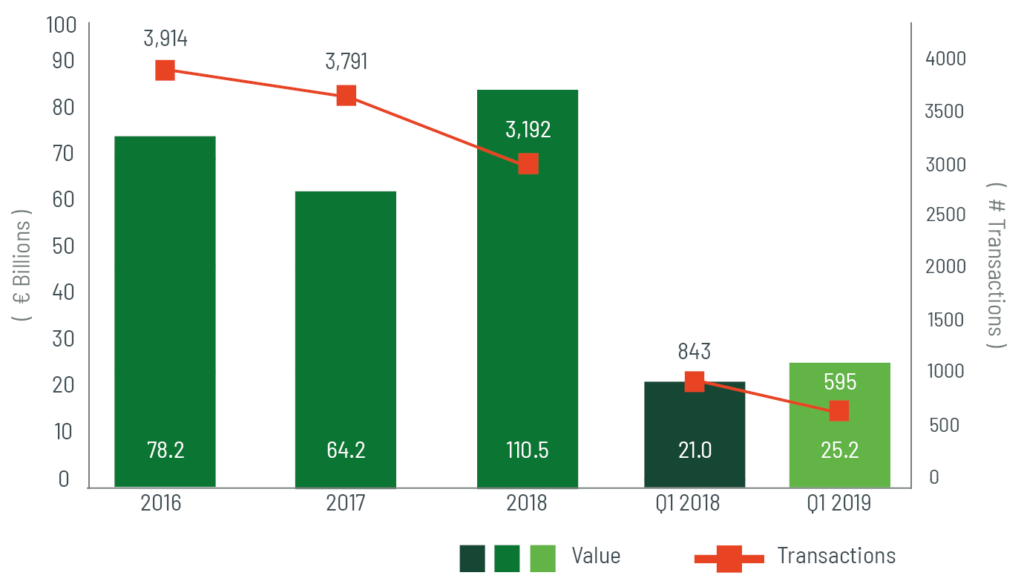

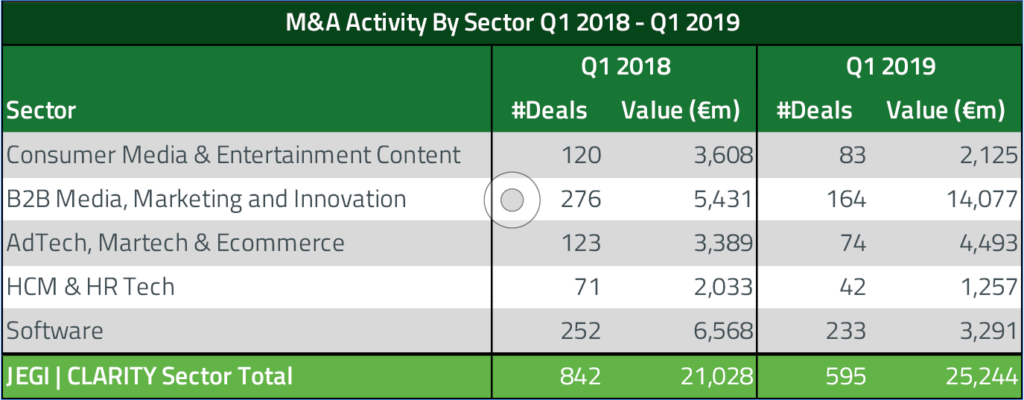

2019 recorded a strong start for M&A deal activity in our sectors with 595 transactions announced in Q1. Whilst we saw a 20% drop on the previous year’s Q1 deal volume, deal value was up 20% with a total of €25.2 billion in the quarter, fuelled in part by ‘mega-deals’ including NEC’s €1.4bn purchase of Danish IT services provider KMD.

The B2B, Media, Marketing and Information sector saw the largest deal of the quarter, a €5.7bn acquisition of Scout24, a public German-based Internet Software company, by Hellman & Friedman and The Blackstone Group.

Consumer media and entertainment content continues to see high levels of M&A activity and peaking valuations, reflecting the shifts in media consumption as demand for content shows no signs of slowing. Roper Technologies’ €475m acquisition of Foundry.

Key Sector takeaways:

Consumer Media & Content

Globally we continue to see high levels of M&A activity in consumer media and entertainment content, reflecting shifts in media consumption, and in turn, strategies for audience monetisation. Entertainment content remains an area where demand for video production technology and services continues to grow.

Software & Technology

Software is still dominating transaction activity within JEGI CLARITY sectors. Notably in the US in Q1 was SAP’s acquisition of CX analytics software company Qualtrics for c$8bn for a business which generated c $400m in revenues in 2018. In Europe activity echoed this, with one example being Nordic Capital’s acquisition of business intelligence and analytics software provider BOARD International in an estimated $500m transaction.

Adtech, Martech & E-commerce

In-housing of adtech/martech and direct-to-consumer digital marketing capabilities continues to drive transactions in Q1 2019. McDonalds Corporation’s c$300m acquisition of Dynamic Yield, an AI-powered personalisation and data management platform is evidence of this.

B2B Media, Marketing & Information

In-housing of adtech/martech and direct-to-consumer digital marketing capabilities continues to drive transactions in Q1 2019. McDonalds Corporation’s c$300m acquisition of Dynamic Yield, an AI-powered personalisation and data management platform is evidence of this.