We examine Private Equity activity in Europe, including interviews with leading Private Equity funds Accel-KKR, Exponent, Livingbridge and Waterland.

Private Equity Activity in Europe

$222bn

Cumulative dry powder in Europe

Dry powder remains strong but with increasing capital chasing fewer transaction opportunities.

-37%

Decrease in transaction volume Q1 2018 to Q1 2019

Macro headwinds, in particular Brexit volatility and risk are slowing transaction volumes across Europe.

53%

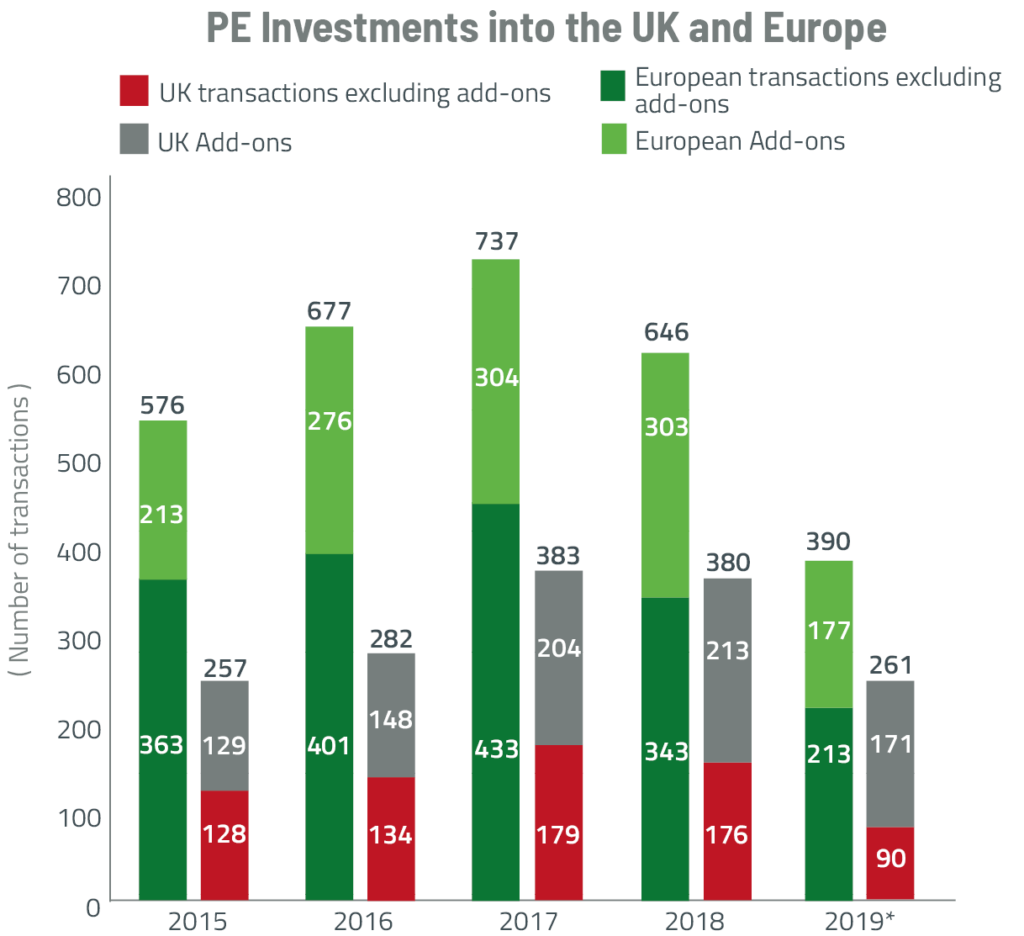

Proportion of total private equity investments that are add-ons in 2019

Increasingly Private Equity funds are focussed on building value in existing portfolio companies.

“Overall, we are long the UK. Brexit has given us a more aggressive stance to deploying capital in the market.”

“At the moment we are decidedly more predisposed to business with an international footprint rather than businesses solely dependent on the UK economy and so less exposed to cyclical downturn.”

“Brexit hasn’t impacted our appetite for investing. We invest in high growth businesses in the mid-market which are often disruptive in niches and as such we are comfortable that they can grow irrespective of the political and economic situation.”

“From an investment perspective, as we do invest in the UK, Brexit has not affected our overall appetite to invest in the UK or elsewhere.”

Slowdown in new platform investments

New investment in Q1 2019 was 37% down on Q1 2018.

Uncertainty around Brexit and further macroeconomic factors across Europe have contributed to slowing transaction volumes as sellers wait to see a more stable market to transact and buyers have to work harder to navigate the investment landscape.

Increasing focus on portfolio companies:

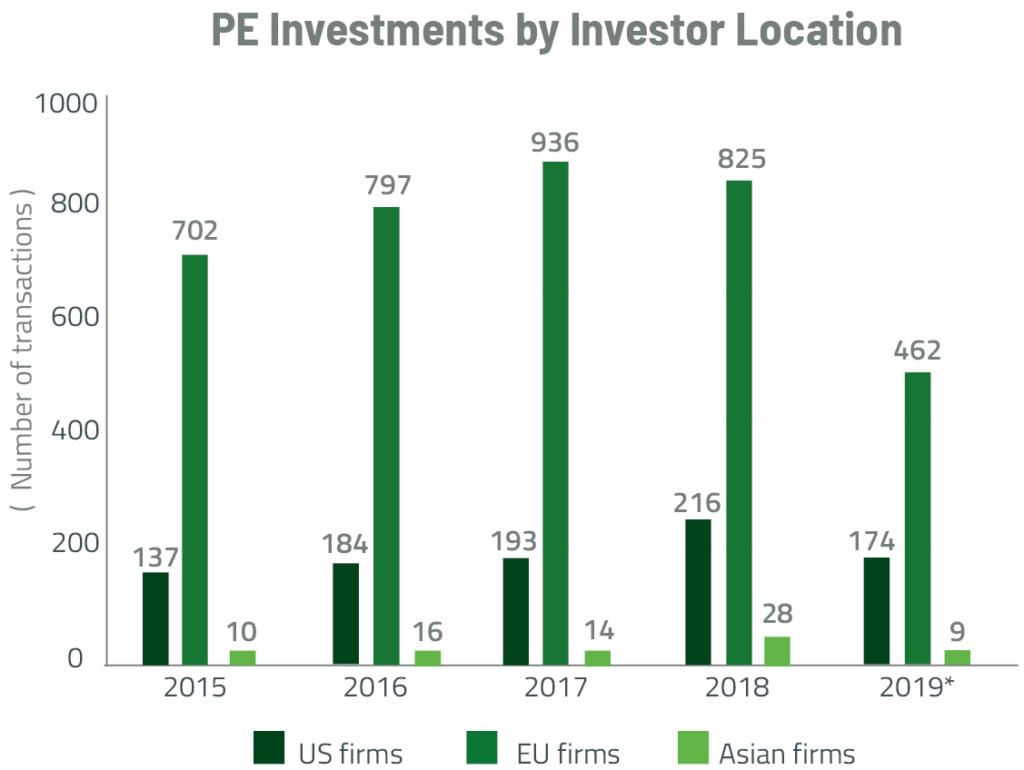

Growing competition from US funds:

With the US markets growing ever more competitive US firms are increasingly deploying capital in European companies.

• The proportion of total investments in European firms by US investors has increased from 16% in 2015 to 27% in 2019

• Decrease in the proportion of investments made by European firms from 83% in 2015 to 71% in 2019