This month we published our Annual Marketing Industry M&A Report, providing a global overview of transaction activity and trends in the industry in 2018.

We have summarized a subset of our insights and data on deal volume, type as well as geography below.

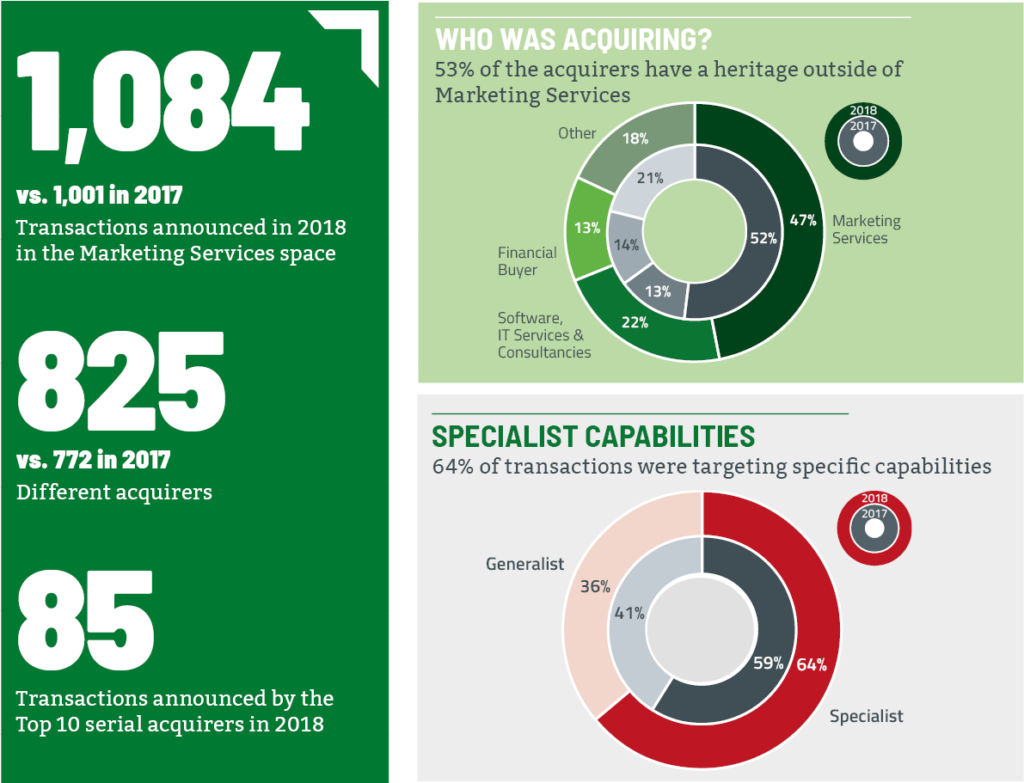

Specialist Capabilities:

64% of transactions were targeting specific capabilities

- In 2018 the demand for specialist capabilities increased and represented nearly two-thirds of the total acquisitions

- Full Service Digital means less and less in a world of more specialisms…

- ‘Specialist Digital’ remains the most sought-after specialist capability with 206 transactions announced in the year

- ‘Marketing Tech’ continued to be in strong demand in 2018 representing 16% of all deals, compared to 10% in 2016, as a result of further industry expansion and consolidation

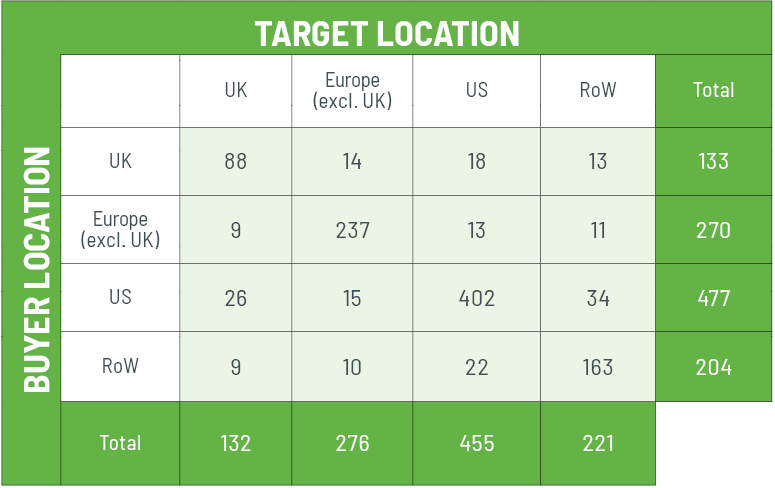

Where are targets located?

In 85% of all transactions the acquirer was either European or American, with 75% being domestic transactions.

North American companies acquiring in Europe represented the largest proportion of cross-border transactions, 46, followed by European companies acquiring into North America, 33 (of which 20 had UK-based acquirers).

Transactions by acquirer type

- The proportion of non-traditional Marketing Services acquirers continued to grow in 2018, representing 53% of the total transactions compared to 41% in 2016

- The Global Networks continued to represent a smaller proportion of total deals in 2018 (6% compared to 9% in 2016)

- In 2018 we saw IT Services, Software and Consultancy acquirers further enhancing their digital capabilities in the design and advertising arena, representing 22% of the total deals announced in the year