The events industry has bounced back faster than expected, its value has been proven and even strengthened by Covid. Investors are jumping back in to access deal opportunities across the size spectrum in the ecosystem.

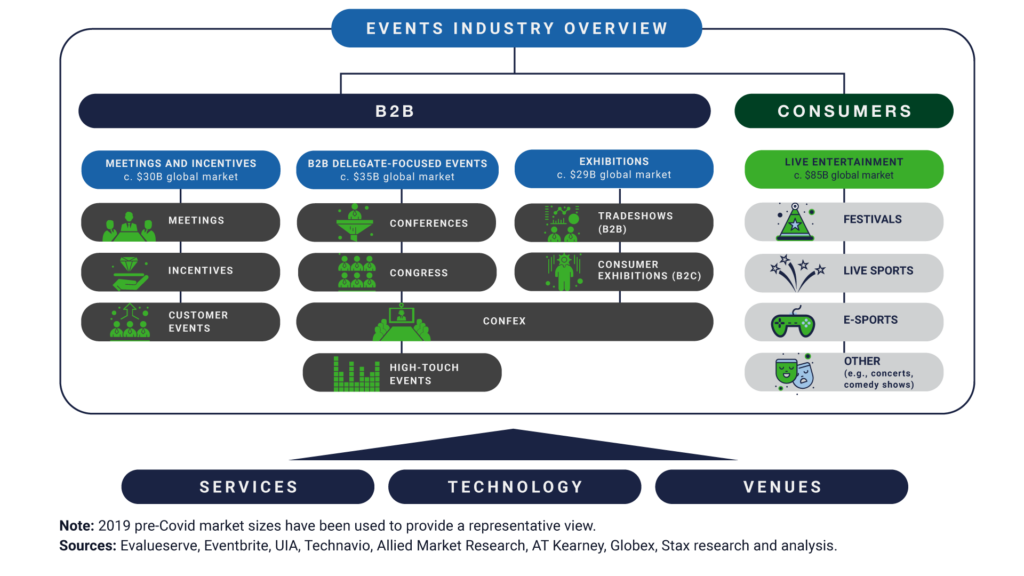

Renewed importance of a diverse industry

Three years ago, Covid brought the world to a complete halt and the Face-to-Face (F2F) industry, be it exhibitions, tradeshows, conferences, 1-2-1s, experiential events, or corporate events, was one of the most affected sectors. Today, the F2F industry is seeing renewed importance as attendees are flocking back to all forms of events with irrefutable energy and motivation.

Event participants have a heightened appreciation for the value and unique advantages of meeting F2F in environments that foster networking, building new relationships, collaboration, and a more focused learning environment. Net Promoter Scores (NPS) evidence this. Pre-pandemic, industry benchmarks put average visitor NPS in the +5 to +7 range, with average exhibitor NPS being negative. Explori reported a post-Covid increase of 20 points in the NPS average in 2021 as F2F resumed. With these higher levels of engagement and satisfaction among attendees, sponsors and exhibitors are also reaping the benefits and strengthening their commitment to the category. A Stax survey of 196 sponsors of corporate events showed an uplift of 29% in perceived value of events from 2019 to 2023, with net sentiment increasing from slightly positive to positive. More broadly, the shift to remote and hybrid work has created an environment where F2F is significantly more valuable now for selling, marketing, and networking as well as for corporate team building, strategy, engagement, and culture. These positive views are here to stay.

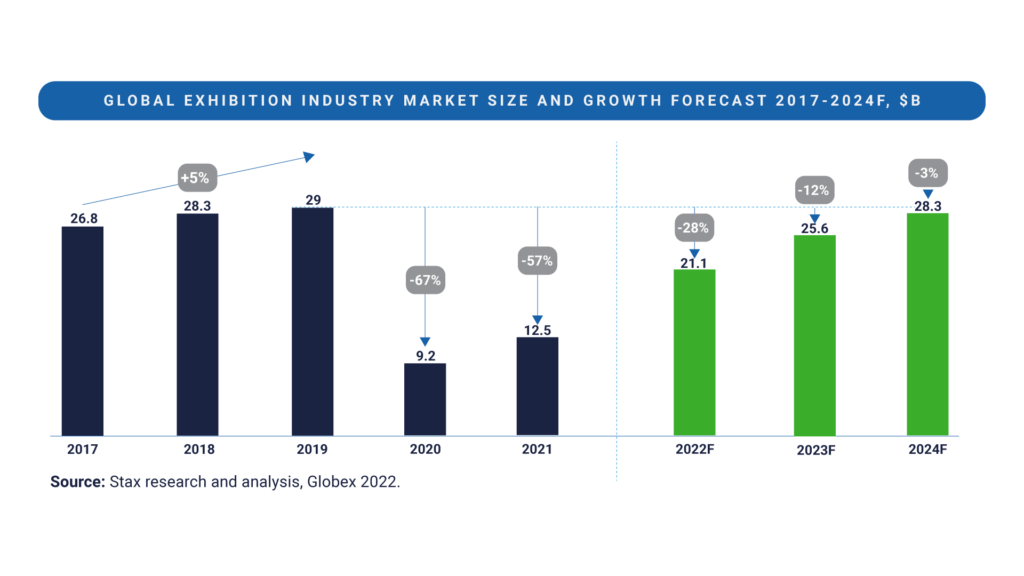

Full recovery of market size

The global exhibition organizing market has traditionally grown ahead of GDP, for example, growing at 5% annually from 2017 to 2019 when it reached a total value of $29B. But Covid halted this growth dramatically in its tracks, with the market shrinking by 69% to $10B in 2021.

With Covid re-proving and even enhancing the value of proximity and immersion brought by F2F, near-full recovery is forecast in 2023. Growth is established at or above pre-pandemic levels and the industry will look much the same. F2F remains the core, now enhanced by the accelerated development of adjacent digital products and data during Covid, providing potential for deeper reach into the communities served by event brands.

Beyond exhibitions, the recovery and growth rates of other segments of F2F such as meetings & incentives and delegate-focused events are mirroring or even outperforming the sector. In addition to organizers, service providers to the industry such as contractors and other suppliers are also benefiting strongly from the return and can expect continuing growth.

This bounce-back has not been universal, however. Asia has been restrained by China’s zero-Covid policy, but that market has now reopened. Domestic growth in China will continue, but organizers will look at other trade flows for event participation. Smaller, weaker events are not returning, but we are seeing a substantial increase in event launch activity as organizers target emerging sectors, mostly with a tech focus.

The rationalization of virtual

The pandemic highlighted the analog nature of the industry, with only 2% of digital revenue in 2019. The emergency dash to digital brought some success and innovation, but limited monetization. Efforts were mostly failures, most of the stopgap efforts were not repeated.

While digital technology allowed us to stay connected and continue to do business during difficult times, we now have the proof-point that virtual events cannot fully replace the real human connection that helps brands build visibility and trust. Only a small set of events such as some delivering training and educational content have remained exclusively online now that it is possible to meet in person again.

Coming out of the pandemic, we are seeing the number of virtual platforms decreasing. When Covid hit many event organizers scrambled to shift their in-person offerings to virtual. Now we are seeing rationalized offerings that augment F2F, extend engagement to 365, and provide opportunities for performance-based marketing, broader content engagement, data collections, and analytics. Digital revenues will not expand as rapidly as predicted in the pandemic, but we expect them to grow at double-digit CAGR to contribute over $1B by 2024, substantially up from the pre-Covid levels of c.$650M. Much of this will be driven by the monetization potential of standalone offerings that extend F2F exhibitions (e.g., 365 year-round digital services, marketplaces, newsletters) being realized.

Transformation to community and customer value

Although events have proven value standing alone, winning organizers had already embarked on a journey of transformation before the pandemic, recognizing the need and opportunity to give customers greater value. Informa’s IIRIS data strategy is a major investment in customer closeness. Italian Exhibition Group announced its community catalyst strategy, others are taking similar initiatives .

We also see other changes to business models, mostly driven by acquisition. Emerald’s acquisition of Bulletin complements its NY gift fair and makes a serious entry to marketplaces. Organizers Clarion, Hyve, and Tarsus have all acquired businesses that organize one-to-one meetings, seeking to spread that competence across their portfolios. Overall, the industry is evolving towards greater use of data and technological integration, allowing it to increase market reach and audience involvement.

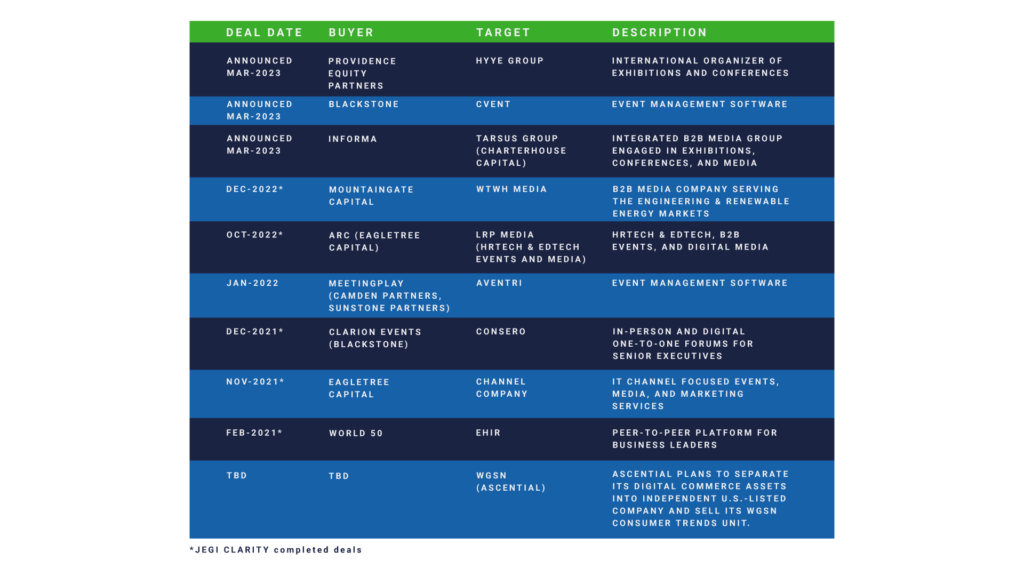

Transactions are back

With F2F back on track to pre-pandemic levels and the industry stronger, investor confidence has also returned. This is shown by the slew of major and some smaller deals in 2023, proving that the industry is both attractive and investable.

The industry is seeing a return of M&A activity and relatively strong transaction multiples. North America continues to lead the way with a strong market recovery post-Covid and a broad set of actionable opportunities. In 2020, North America saw 88 event-related transactions, followed by 94 in 2021 and 106 in 2022. Europe has also recovered well and has seen a similar M&A pattern with 90 event related transactions in 2020, followed by 98 in 2021 and 96 in 2022. M&A activity in the APAC region remains subdued.

In addition to mainstream traditional events that have rebounded, buyers are looking to acquire “tip of spear” and other innovative business models which enable higher sales conversion and more efficient buyer engagement. These include smaller curated events that occur throughout the year such as 1-2-1 and hosted-buyer events, content-rich conferences delivering critical information to their communities, and focused knowledge-sharing businesses, such as peer-to-peer networks. Investors have the strongest appetite for growing, resilient, global verticals such as healthcare and technology. Given the current macro-economic backdrop they are less focused on cyclical markets such as construction and retail, although software and tech that is driving productivity in any market is a hot topic.

At the end of 2022, the F2F industry saw notable activity. JEGI CLARITY was the sell-side advisor on three event-related transactions in Q4 2022: LRP Media Group’s sale of its HR Tech and Ed Tech B2B event and digital media portfolios to Arc, backed by investment funds managed by EagleTree Capital; e.Republic, a media, research, data and events company, sale to Leeds Equity Partners; and the investment in WTWH media, an integrated B2B media company that includes 12 events, by Mountaingate Capital.

Fast forward to March 2023, the industry saw three large and transformative acquisition announcements. Informa plans to acquire Tarsus, operator of 160+ B2B event brands, for $940M. Less than a week later, Blackstone, a fund focused on events and travel recovery, announced it has entered into a definite agreement to acquire meetings, events, and hospitality tech provider Cvent for $4.6B. Shortly after, Providence Equity Partners, partnering with Searchlight Capital Partners announced that they had made an offer to acquire Hyve Group, a U.K. event organizer for $579M, approximately 20.3x EBITDA for FY22.

Stax has been equally busy over the past 12 months with six sell-side and buy-side commercial due diligences across exhibitions, conferences, and experiential, as well as its other strategy and transformation work in F2F.

Select deals in F2F

We will also see a wide range of investment opportunities in the broader ecosystem beyond event organizing. Service providers that support organizers are now in a stronger position than pre-Covid. Building from their downsized bases, these providers are enjoying strong growth in line with the faster than anticipated industry bounce-back. With some scarcity of supply, many players are able to command higher prices from customers and improve margins.

The $4.6B Cvent investment underpins the attractiveness of technology players that support meeting and event organizers as well as their participants. In venues, while there is overcapacity in some parts of the world, the value or specialized, flexible pace is highlighted by Convene’s investment in etc.venues.

Further investment ahead

With continuing positive fundamentals, we can expect to see more transactions throughout the ecosystem. Private equity investors such as Blackstone, Providence, Charterhouse, EagleTree, and others have made strong returns repeatedly across a number of deals. They will be joined by others attracted by the quality of the industry’s fundamentals and its recovery.