Key Takeaways

Gamers and Other Super Users are an Attractive Audience

- Gamers belong to an attractive demographic: young, affluent, educated, and technologically savvy

- Gamers are highly aware and proficient in using cutting edge technologies such as NFTs and crypto – the space is an excellent incubator for new tech

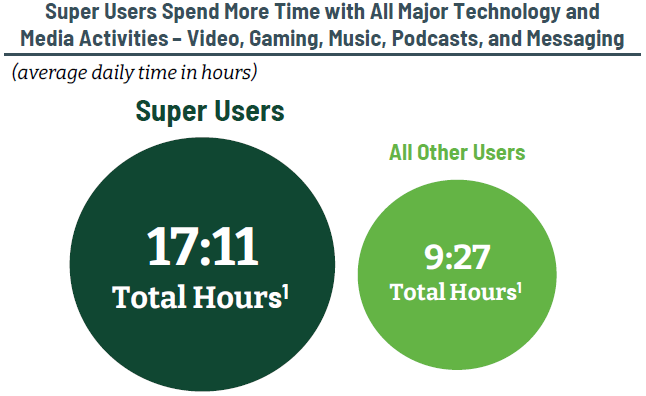

Super Users tend to be younger and more affluent than their counterparts, making them more valuable to technology and media companies

Strong secular growth potential

- The gaming industry has double-digit growth historically and very strong growth prospects going forward

- Overall strong growth attributable to increases in both: spend (p) and audience (q)

Outperformance through Covid

- Gaming revenue grew +20.0% (+11.2% outperformance) in 2020

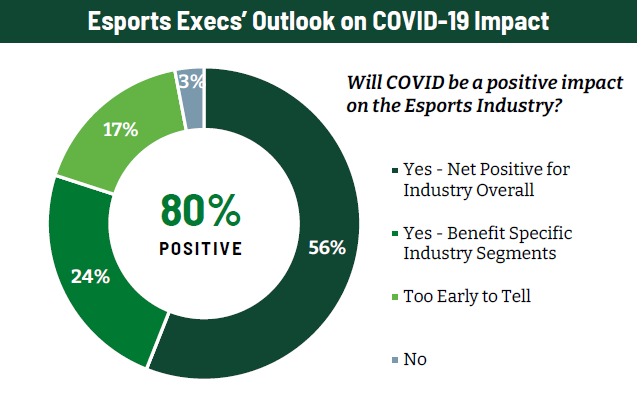

- 80% of business in esports and gaming see covid as a positive impact on their business, creating a new watermark

COVID has accelerated the capture of prevailing esports audience growth trends furthering the paradigm shift towards interactive digital media consumption

More than games

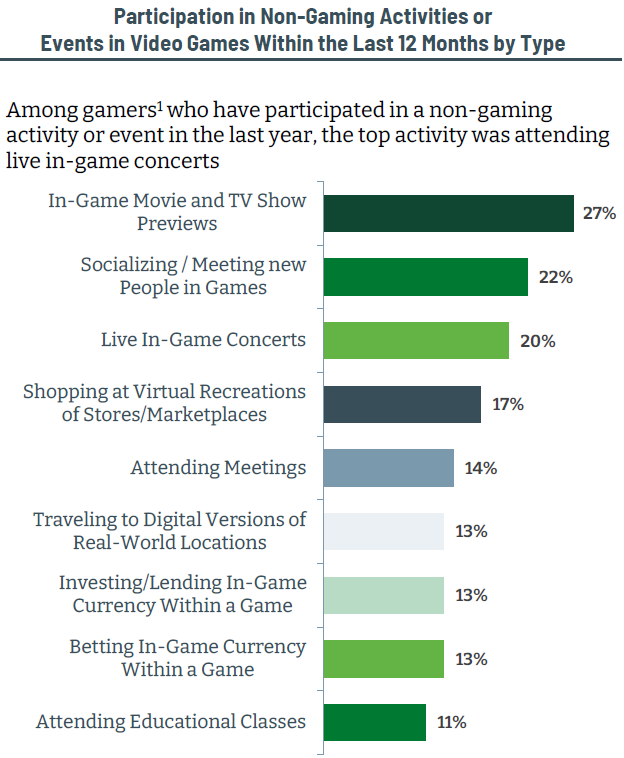

- 60% of gamers have participated in a non-gaming activity or event inside a video game engine within the last 12 months

- Event types include watch parties, concerts, graduations, visiting virtual recreations of real-world locations

Highly attractive business models ripe for investment

- Gaming and esports businesses have high growth potential and scalable operations

- High-quality assets are at the critical inflection point of achieving profitability and generating cash flows

- All stakeholders are looking for partnerships to scale the business to the next level – find the business within the science project