This month we examine the digital marketing industry including the key current drivers of growth, why brands are increasingly ‘In-Housing’ and global M&A activity in the sector.

Digital marketing growth drivers

- c.47% of UK & US ad spend is digital, up from 17% in 2010

- Stability in digital ad spend due to measurable ROI and CTR1

- Digital ad prices are rising – CPM2 on Facebook from $4.3 to $9.1 and CPC3 on Google from $1.6 to $2.7 between 2015 and 2018

- More relevant ad space is available due to media digitization

- Consumers spend increasing time online with access to more digital

- Tech development are opening new opportunities for digital marketing

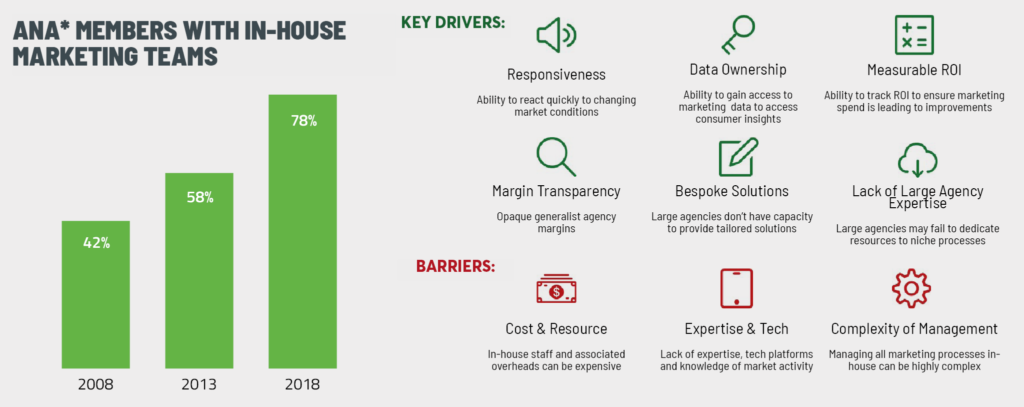

- Companies are developing in-house capabilities

In-housing has been a hot topic in boardrooms

Brands are seeking greater control of digital marketing as this is increasingly viewed as a sales channel as much as a marketing channel.

Global M&A activity increasing in performance marketing

Global M&A activity in performance marketing services has increased in recent years. The growing digitalisation of media and rising digital ad costs are driving consolidation in the sector.

• Whilst the Global Networks continue to be most acquisitive in this space, consultancies (such as Accenture) and PE-backed platforms (such as Elite SEM and Wpromote) were also prominent.

• We expect M&A to remain active in 2019 with several acquisitions already announced including the investment in leading technologyled marketing agency, Brainlabs, by private equity fund Livingbridge (JEGI | CLARITY advised Brainlabs on this transaction).