Key Highlights

Cash and investments held by US corporations rose 30% to $2.5T in the first half of 2020

34% of divestitures had a Private Equity buyer in 2020

9.7% annual shareholder return for companies with focused divestitures and M&A programs

Companies with active M&A programs continue to outperform inactive companies

Corporate Divestitures Remain a Robust Part of the M&A Market; Trending Back up Post the Pandemic

Organizations tend to review their portfolios and go through corporate divestitures more aggressively post economic crises, as evidenced by strong divestiture activity post the financial crisis during 2008-2009. Given a heightened sense of risk and a desire to focus on growing core parts of their organizations, corporations are already evaluating noncore assets in order to free up cash to pay down debt, leading to uptick in the corporate divestiture activity in Q4 2020 and Q1 2021.

A heightened sense of risk has caused corporations to evaluate noncore assets in order to free up cash to pay down debt

Companies With Active M&A Programs Outperform Inactives

Based on total shareholder returns generated over comparable periods, companies with focused divestitures and M&A programs tend to outperform organizations that have stayed relatively inactive.

Growing role of Private Equity Players as Buyers

Private Equity firms will continue to play a substantial role in divestitures as they accounted for a record 34% of buyers in 2020. The number of private equity firms focused on carve outs and “complex” deals continues to rise.

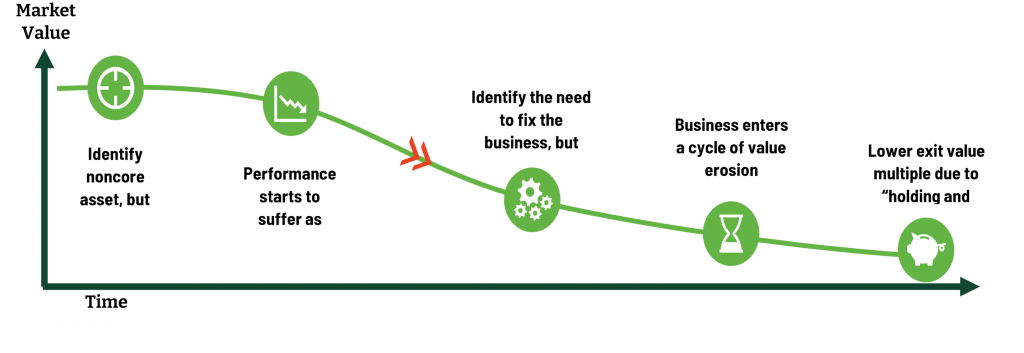

Perils Of Holding On To Non-Core Assets For Too Long

In Summary

With Private Equity continuing to be a driving force we anticipate the market for corporate divestment activity to remain buoyant. Equally as we are still in the process of emerging from the pandemic companies will continue to need to assess how they service debt requirements. M&A should be an important part of the discussion around board tables.