Livingbridge backs marketing agency Brainlabs

Livingbridge has made an investment in London-based Brainlabs, a marketing agency. JEGI CLARITY represented and advised the shareholders of Brainlabs on the transaction.

Livingbridge has made an investment in London-based Brainlabs, a marketing agency. JEGI CLARITY represented and advised the shareholders of Brainlabs on the transaction.

Global specialist media platform Future plc today announced the acquisition of Mobile Nations (MoNa Mobile Nations, LLC), a U.S.-based leading global digital publisher focused on consumer electronics.

We examine the market opportunity and the drivers behind the high levels of transaction activity across the international HCM market.

Growing at 9% CAGR

Including Recruit’s $1.2bn purchase of Glassdoor and Microsoft’s $400m acquisition of Glint

Continuing into 2019 with Ultimate Software’s $11bn Sale to Private Equity

People as resources/expenses: Having spent decades installing ERP, SCM and other automation systems, enterprises have now recognized that their people can be their biggest competitive advantage, and also their largest cost item. The ability to drive efficiencies from their workforce is paramount.

War for talent: A combination of historically low unemployment, rise of the gig economy and a millennial workforce is driving the need to attract, engage and retain talent.

Skills gap: Increasing need to train employees and provide the L&D platforms, tools, and analytics to deliver and measure.

Need for proactive insights: Pent-up demand in HR to harness data to generate predictive insights to help pro-actively drive business decision making, in line with other areas of enterprise.

Acceleration of HCM SaaS: HR was one of the earliest consumers of SaaS-like models with Payroll and other SaaS HCM increasingly mainstream.

Global opportunity: Macro tailwinds will continue to propel the HCM market worldwide driving underlying sector growth.

Growth of Private Equity capital: Increasing deployment of private equity capital into sector, in particular into Europe.

AI & analytics: Roll out of next-gen data, analytic, and AI platforms to drive forward looking decision making.

High valuation multiples: Sector valuation multiples will continue to outperform non HCM peers, with software and tech-enabled services carrying SaaS multiples.

One of the few horizontal software markets remaining: A fragmented global market with multiple opportunities for consolidation, through broadening product suites and new market entrants.

BV Investment Partners, a middle-market private equity firm focused on the business services, software and IT services sectors, announced that it has acquired a majority interest in RKD Group.

Marcus Anselm, Partner at Clarity, has been included in Campaign’s A List for 2019, making up the most powerful people in advertising and media.

Campaign comments on the sale of the remaining 24.9% of Blue 449 to Publicis.

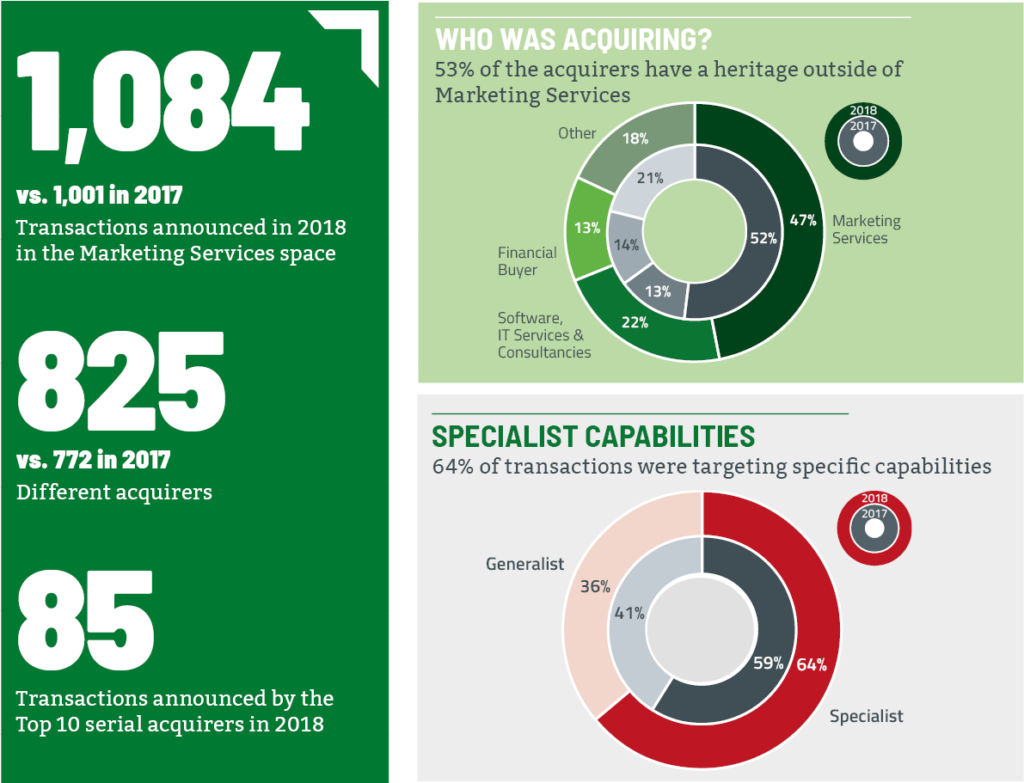

This month we published our Annual Marketing Industry M&A Report, providing a global overview of transaction activity and trends in the industry in 2018.

We have summarized a subset of our insights and data on deal volume, type as well as geography below.

64% of transactions were targeting specific capabilities

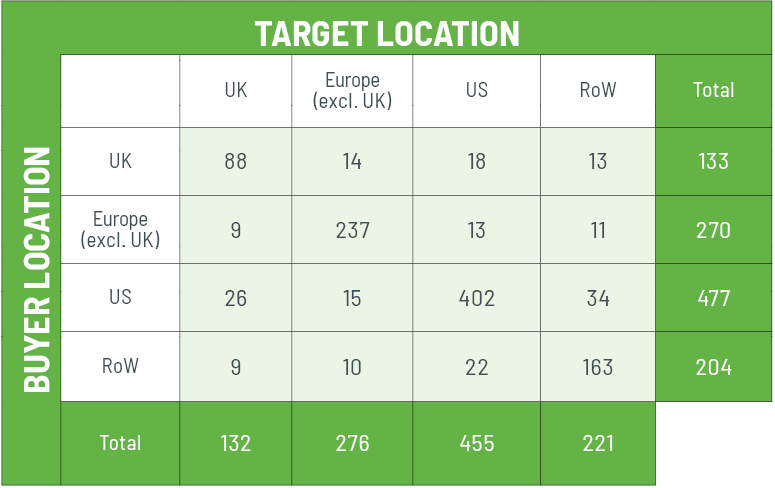

In 85% of all transactions the acquirer was either European or American, with 75% being domestic transactions.

North American companies acquiring in Europe represented the largest proportion of cross-border transactions, 46, followed by European companies acquiring into North America, 33 (of which 20 had UK-based acquirers).

Location: 10 On the Park, Time Warner Center, New York City

View the full conference program here.

The 15th annual JEGI CLARITY Media & Technology Conference was a preeminent, can’t-miss event for nearly 500 senior executives across the media, marketing and technology sectors. The conference provided key insights from high-profile speakers across JEGI CLARITY’s core markets on how to stay relevant in today’s fast-paced and rapidly evolving landscape.

We would like to thank our valued, blue-chip sponsors for supporting the event:

BDO (www.bdo.com)

Boston Consulting Group (www.bcg.com)

Capital One (www.capitalone.com)

Intralinks (www.intralinks.com)

Koller Search Partners (www.kollersearch.com)

Morgan Lewis (www.morganlewis.com)

Oracle Netsuite (www.netsuite.com)